Life Insurance Tax Benefits in India

Jun 05, 2025

PNN

New Delhi [India], June 5: Life insurance is not just a tool for financial protection but also an effective way to save on taxes. In India, the Income Tax Act provides various benefits for policyholders, making life insurance a popular choice among taxpayers. This article delves into the life insurance tax benefits, how they work, and why they are an integral part of financial planning.

Key Tax Benefits of Life Insurance

Deduction Under Section 80C

One of the most significant advantages of life insurance is the tax deduction available under Section 80C of the Income Tax Act. This policy makes a holder eligible for deductions up to Rs1.5 lakh on premiums they pay towards life insurance coverage. This benefit applies to policies covering:

* The policyholder

* Their spouse

* Their children (dependent or independent)

Tax-Free Maturity Benefits Under Section 10(10D)

The maturity proceeds or death benefits received from a life insurance policy are exempt from tax under Section 10(10D), provided certain conditions are met:

* The premium is less than or equal to 10% of the sum assured given in a policy issued after April 1, 2012.

* For policies issued before April 1, 2012, the premium should not exceed 20% of the sum assured.

This exemption ensures that the financial benefits intended for your family's security are not eroded by taxes.

Tax Deduction on Riders

Additional riders like critical illness or accidental death benefit riders attached to your life insurance policy may also qualify for tax benefits under Section 80C. This section allows deductions for premiums paid towards health-related riders.

You can use an income tax calculator to have a better idea of your tax obligation.

Using a Life Insurance Calculator for Tax Planning

A life insurance calculator can be a valuable tool to estimate the tax savings from your policy. By inputting details like your premium amount and sum assured, you can:

* Calculate potential deductions under Section 80C and 80D.

* Determine the tax-exempt maturity amount under Section 10(10D).

* Plan your investments to maximize tax benefits.

Benefits Beyond Tax Savings

Financial Security

While tax savings are an added advantage, the primary purpose of a life insurance plan is to provide financial security to your family in case of unforeseen events.

Wealth Creation

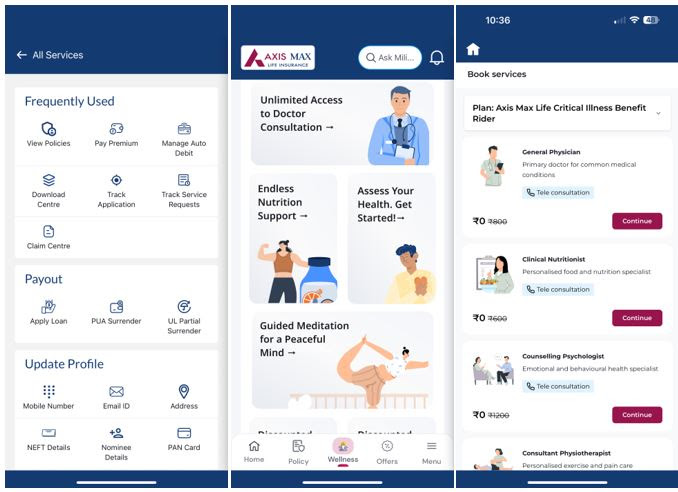

Certain policies, such as ULIPs or endowment plans, offer investment benefits alongside life coverage. These policies help you grow your wealth while ensuring tax efficiency.

Retirement Planning

A life insurance policy can serve as a long-term investment tool, helping you build a corpus for your post-retirement life. The tax exemptions enhance the overall returns from such investments.

Things to Keep in Mind

* Ensure that the policy complies with the conditions mentioned under Sections 80C and 10(10D) to claim tax benefits.

* Premiums paid towards group insurance policies may not always qualify for deductions.

* Regularly review your policy to align it with your financial goals and tax-saving requirements.

Conclusion

Life insurance tax benefits play a crucial role in reducing taxable income while ensuring financial security for your loved ones. Leveraging tools like a life insurance calculator can help optimize your investment and tax-saving strategy. Whether you aim to protect your family's future, build wealth, or plan for retirement, a life insurance policy provides a comprehensive solution with the added advantage of tax efficiency. Make informed choices to maximize these benefits and secure your financial future.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by PNN. ANI will not be responsible in any way for the content of the same)