Glenn Hanson Joins Raveum Board, Empowering Indian Investors to Co-Own U.S. Real Estate

Jun 19, 2025

PNN

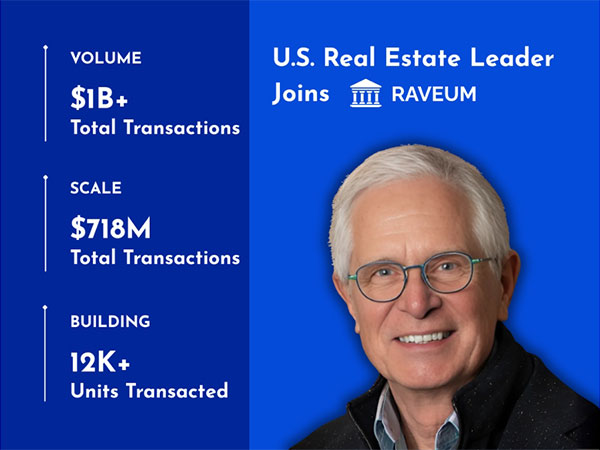

Austin (Texas) [USA], June 19: In a decisive step toward democratizing global wealth, Raveum, India's first RBI, FEMA, and U.S. SEC-compliant platform for co-investing in institutional-grade U.S. real estate, has welcomed Glenn Hanson, Founder and CEO of Colony Hills Capital, to its Board of Directors. Known for structuring over $1.2 billion in U.S. multifamily real estate investments, Hanson's appointment signals a transformation--not just for Raveum, but for Indian investors seeking transparent alternatives to volatile stocks, bonds, and domestic property markets.

Founded by fintech entrepreneur Kabir Israni, Raveum offers Indian investors something they've never had before: direct access to U.S. commercial real estate deals once reserved for hedge funds, REITs, or ultra-high-net-worth circles. It's not just an app--it's a trust infrastructure. From RBI's Liberalized Remittance Scheme (LRS) to compliance with FEMA and U.S. SEC regulations, every layer of the platform is engineered to earn investor confidence. Transactions are processed securely via Raveum's official platform, with all remittances routed through Kotak Mahindra Bank.

At a time when Indian investors are increasingly disillusioned with underperforming mutual funds, stagnant domestic property markets, and the rupee's continued depreciation against the dollar, Raveum offers a compelling alternative to traditional stocks, bonds, and local real estate. By enabling co-investment in high-rental-yield U.S. properties, assets rarely accessible in India, Raveum delivers dollar-denominated income with the transparency and structure of institutional finance.

For Glenn Hanson, this isn't just a title, it's a continuation of a four-decade mission. As CEO of Colony Hills Capital, Hanson has led the acquisition and oversight of 36 multifamily properties totaling over 12,000 apartment units. His firm currently manages $718 million in assets and is set to deploy $400 million annually. But his experience runs deeper. He co-founded River Valley Investors, one of New England's most respected angel networks, and has held board positions across fintech and academic institutions.

Hanson's alignment with Raveum is personal. "I was introduced to Kabir by Bitcoin's original CTO nearly three years ago," he said. "Since then, I've closely observed his unwavering commitment to building Raveum with deliberate precision, discipline, and a maturity that sets him apart. I'm proud to join the board and support the scaling of this visionary platform, one that opens the door to real estate investing for individuals who might otherwise never have access to such opportunities."

This isn't marketing fluff, it's the story of access. Through co-ownership, Raveum allows Indian investors to bypass the legacy gatekeepers of international property: no shell companies, no legal gymnastics, no ambiguous intermediaries. It's a fintech product with the governance discipline of an asset manager. And its latest offering speaks volumes.

Encore at Murrells Inlet, Raveum's newest co-investment opportunity, is a Class A build-to-rent (BTR) luxury residential community comprising of townhomes, located in South Carolina's affluent coastal corridor. The asset is already commanding an average $221/unit premium on new leases, with minimal capital expenditure required. On a five-year hold, it's projected to generate an 18% internal rate of return (IRR) and a 6.7% average annual cash-on-cash yield (estimates only). Now open to Indian investors, Encore represents the exact kind of secure, yield-focused investment Raveum was built to unlock. View Offering Here.

Raveum's rise is more than a fintech story--it's a shift in how Indian capital moves. With INR volatility and limited domestic real estate growth, the search for global, dollar-income strategies has intensified. Stocks and bonds continue to fluctuate with geopolitical cycles, but stabilized U.S. real estate, backed by long-term leases and institutional underwriting, provides a hedge Indian investors increasingly trust.

The platform's compliance architecture is rigorous. Property listings undergo third-party audits, KYC is enforced on every investor, and funds flow through audited channels with oversight. Raveum operates fully under the Reserve Bank of India's LRS, FEMA regulations, and the investor protection standards of the U.S. SEC. Unlike many overseas real estate deals that operate in grey zones, Raveum offers clarity, and credibility.

For Kabir Israni, this moment is the result of nearly three years of silent execution. "When we launched Raveum, the idea was simple: empower every Indian to participate in wealth creation beyond borders," Kabir said. "Glenn's involvement validates that vision, not just technically, but emotionally. He sees what we're building."

And what they're building is more than a platform. It's a category. A new frontier in Indian financial planning. The average investor in India has been told to buy a flat, invest in a SIP, or chase NFOs. Raveum offers something else: the chance to co-own stabilized U.S. real estate and earn dollar income, all from a smartphone.

With Glenn Hanson now part of the boardroom, and Encore open to Indian co-investors, Raveum isn't pitching a possibility, it's delivering access. The startup is scaling not just capital, but trust. In a world where wealth strategies are increasingly global, platforms that deliver both transparency and yield will define the next generation of financial infrastructure. Raveum may well be leading that charge.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by PNN. ANI will not be responsible in any way for the content of the same)