Debt Nirvana Co-Founder Ravi Malhotra, felicitated at ET Inspiring Leaders Awards 2023

Nov 27, 2023

PNN

New Delhi [India], November 27: In a world where innovation, leadership and entrepreneurial spirit drive progress, it is imperative to celebrate the excellence of the leaders who pave the way for success in business. It is that time to recognise the visionaries, showcasing their collective impact underscores the transformative power of visionary leadership in shaping the future of business and innovation.

ET Inspiring Leaders Awards 2023, which honours and recognises those who have made remarkable contributions across sectors, is scheduled to be held on November 8, 2023, at Hotel The Grand, New Delhi. Ravi Malhotra, Co-Founder of Debt Nirvana, was felicitated at the ET Inspiring Leaders Awards ceremony by the well-known Bollywood Actress Jacqueline Fernandez.

Speaking after being felicitated, Ravi responded, "The journey for an entrepreneur is an arduous and unique one. I would like to thank the Economic Times and jury members for recognising my work and honouring me with this award. It fills me with gratitude and the feeling is incredible."

Debt Nirvana works with 100+ clients across Asia to help them with their revenue flows, doing all business on credit. Be it an overdraft, a short-term loan, or staggered receivables, if you are in business, you are most likely to owe someone money, just as someone would owe you money. For husband-wife duo Ravi and Shilpi Malhotra, it was this large market opportunity that compelled them to leave their secure jobs at Google India and start-up.

Ravi and Shilpi Malhotra, Co-founder of Debt Nirvana, worked in areas of revenue assurance and credit risk mitigation and saw an acute problem that plagues the industry, big or small. Ravi mentioned, "We basically provide an end-to-end solution from a revenue perspective. One of the major problems that corporate India is facing is that they are not able to collect their payments or receivables on time."

Mitigating risks: the best way to avoid the risk of late payments is to understand the creditworthiness of companies. And that's where Debt Nirvana's solution comes into play, as it analyzes the creditworthiness of a company's clientele based on management's operational details, financial statements, revenue growth chart, complete analysis, and its standing in the industry. The platform also analyzes and takes into account a company's social imprint. However, what sets Debt Nirvana apart is that, as part of its analysis, it makes sure that there is also physical verification done by leveraging its partner network, which is present across 270 cities in India. Ravi added, "We have helped Fortune 100 companies prevent fraud since the company in question wasn't present at the same address. So, these small things can make a huge difference." The second solution offered by Debt Nirvana is end-to-end revenue management, which takes over from sending invoices to managing receivables.

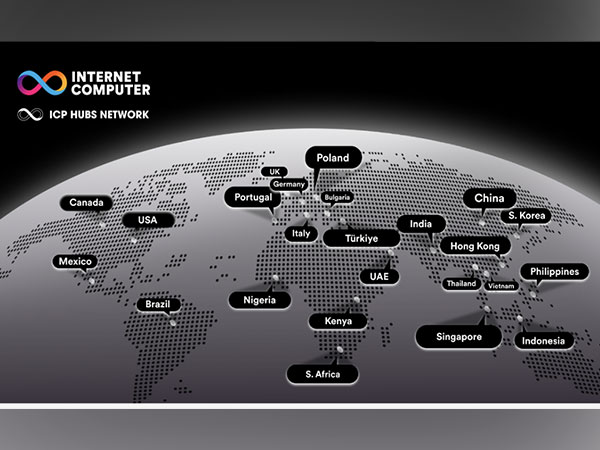

At present, Debt Nirvana handles more than $500 million per year in terms of revenues for its major clients, some of whom are in Fortune 100 categories across the Asia Pacific and Global regions. Ravi states, "The value addition that we provide is that we are a research-based debt engine. During our assessment, we try to track down the key decision-makers of these companies and track down the reason for the non-payment." This ensures higher success rates in the collection of these bad or sticky debts. Debt Nirvana claims to have 58-60% success in terms of collection in India. In the international market, the firm has a 60-65% success rate on collection. Debt Nirvana works with 45 big companies at present, and some of its clients are Schneider Electric, Global Office Space Company Regus, and Cinepolis. The company, though, is now looking to enter the financial sector and is looking to acquire insurance and banking clients.

Looking in the future, Debt Nirvana has recently launched B2B credit reports available online, which will reduce manual human intervention and allow clients to get reports instantly. This has enabled our clients to access the B2B database for existing credit reports, wherein clients have to pay instantly via a payment gateway, and reports can be downloaded by clicking a button, irrespective of the different time zones in which clients are sitting.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by PNN. ANI will not be responsible in any way for the content of the same)